Manufacturing Breakdown Finance: How to Fund Emergency Repairs (2025 Guide)

Manufacturing Breakdown Finance: How to Fund Emergency Repairs & Replacement Without Halting Production

When a key machine fails mid-run, you don’t have weeks to “work it out with the bank”. You need a simple, fast way to cover repairs, hire gear or replace the asset so the line keeps moving.

This guide keeps it simple: how to think about breakdown costs, what funding options actually work in a hurry, and how to set things up before the next emergency.

| Business size | Output lost per day | Typical breakdown cost | Simple funding path |

|---|---|---|---|

| Small shop | $8k–$15k | $10k–$40k | Short-term facility |

| Mid-sized factory | $20k–$60k | $40k–$150k | Refinance + top-up |

| Large manufacturer | $80k+ per day | $150k–$500k+ | Dedicated asset finance |

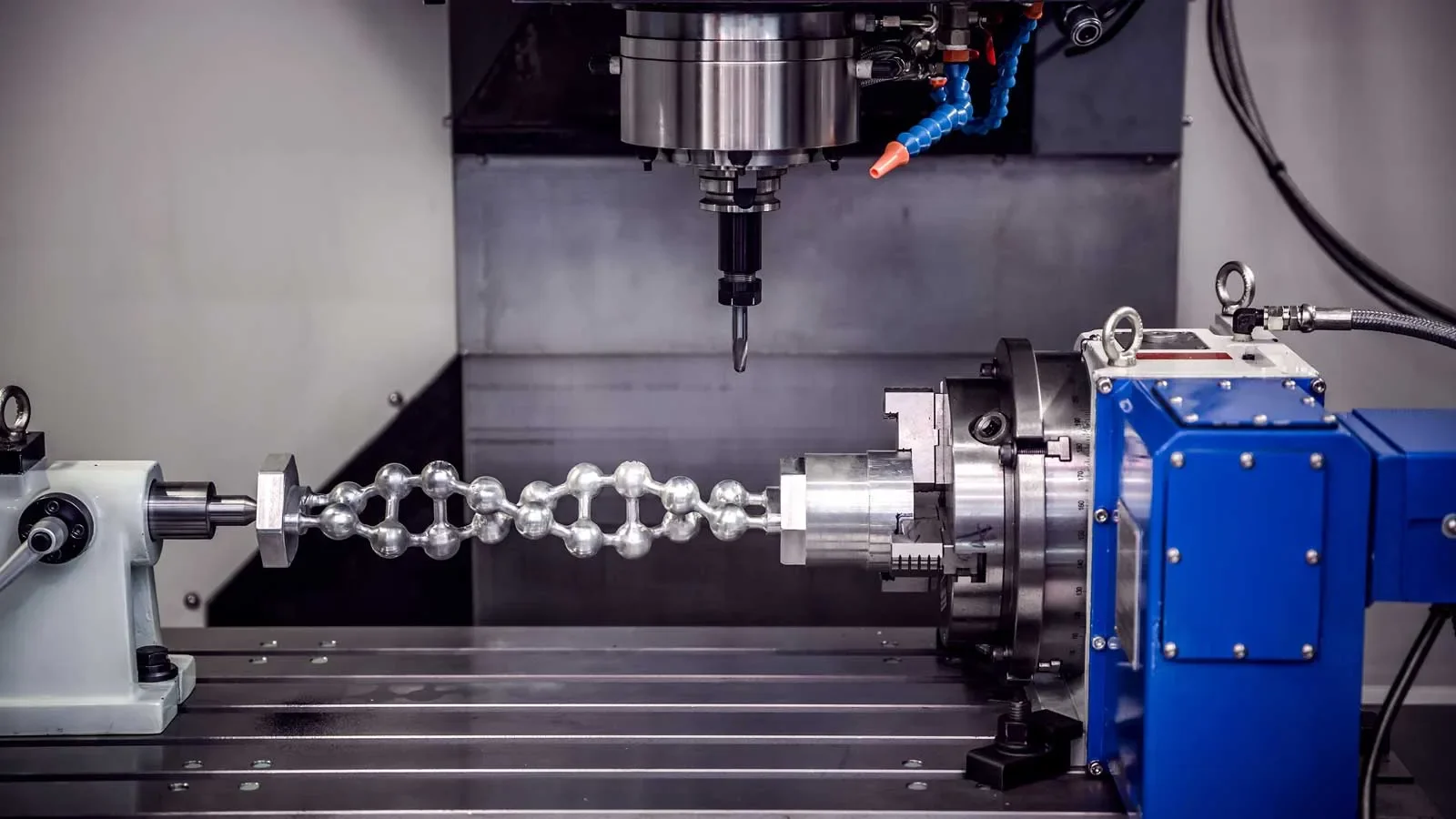

If you run plant, CNC, yellow goods or heavy vehicles, having a simple breakdown plan is just as important as having maintenance schedules and safety checks.

1. What is “manufacturing breakdown finance” in plain English?

Think of breakdown finance as a safety net for when a critical asset fails without warning. The goal is not to overcomplicate it — you just need money quickly, on terms that won’t choke cashflow later.

For many manufacturers, this might be a small Asset Finance top-up, a short-term business loan or a simple restructuring of an existing facility. The key is matching the funding to how long the repair or replacement will keep earning.

A good plan usually combines three simple questions: how big is the hit, how long will the fix last, and how much downtime can you afford before you start losing key customers.

- Smaller breakdowns (under ~$50k) often suit short-term, quick-approval funding.

- Larger failures on core machinery often suit a dedicated replacement or restructure.

- In both cases, you want fast answers, not a long “full doc” process.

A metal fabrication shop has a $90k press fail on a Monday. Each day offline costs ~$25k in delayed jobs. Instead of pausing everything, they line up a simple replacement facility over 3–5 years and use a small, short-term top-up to cover emergency hire while the new press is delivered. The line keeps moving and clients don’t notice a thing.

2. Repair, hire or replace? A simple breakdown decision frame

In the middle of a breakdown, it’s easy for every option to feel urgent. Keeping a simple decision frame on hand helps you stay calm and pick the cheapest path over the full life of the gear, not just this week.

One way to think about it is: repair for short hits, hire when you have a genuine gap, and replace when the machine is clearly at end-of-life. That keeps you away from expensive “band-aid” decisions that feel safe today but cost you more over the next few years.

A short chat with a broker who understands Machinery Finance can help you price these options quickly so your production team isn’t left waiting on an answer.

- Repair – useful when the fix is cheap and the asset still has a long, reliable life ahead.

- Hire – handy when a replacement is coming but you can’t afford downtime in the meantime.

- Replace – makes sense when failures are frequent and the cost of downtime is higher than new repayments.

- Always compare the cost of downtime to the cost of funding.

- Check whether the asset is still aligned with your current and future contracts.

A plastics plant has an older extruder that keeps failing. The latest breakdown quote is $25k, and each failure takes them offline for three days. Instead of paying the repair again, they choose a simple replacement facility and use a small hire unit for four weeks until the new machine arrives. Over the year, they save more in avoided downtime than the extra repayments cost.

3. What do lenders look at when you need money fast?

Even in an emergency, lenders still need a basic picture of the business. The good news is that this can often be done using simple data, without full tax returns or formal accounts, especially if the business is stable and established.

In many breakdown cases, funders lean on things like recent Bank Statements, how long you’ve been trading and how important the asset is to your current contracts. They want to see that keeping the machine running supports revenue, not just adds another repayment.

A broker can match your situation to the right lender’s policy so you are not guessing which option will actually move quickly.

- Time in business and stability of customer base.

- Recent revenue trends and how “lumpy” cashflow has been.

- The role of the asset in delivering your core products.

A CNC shop in Victoria has a long-term contract with a national client. When a machine fails, the lender reviews 12 months of trading, key contracts and recent performance instead of waiting on full financial statements. The deal is structured around the remaining contract term, which keeps both repayments and risk tight.

4. Protecting cashflow after the emergency is over

The breakdown is only the first problem. If the fix leaves you with repayments that are too heavy, you might replace downtime stress with cashflow stress instead. The goal is to get back to normal production with repayments that sit comfortably inside your existing margins.

A simple way to do this is to look at a rough Cash Flow Forecast for the next 6–12 months. Line up the expected extra profit from the repair or replacement against the new cost and make sure there is a clear buffer.

Sometimes the answer is a dedicated asset facility; sometimes it’s a mix of asset funding and working capital so you’re not leaning on one tool for everything.

- Keep repayments as a small, predictable slice of weekly or monthly revenue.

- Avoid stacking multiple short-term loans that all fall due at once.

A food manufacturer has a key mixer fail just before peak season. With their broker, they match the new facility term to the expected life of the mixer and ensure repayments stay under a set percentage of average monthly revenue. Peak-season uplift clears the initial cash hit without leaving the business stretched in the quieter months.

5. Simple steps to set up a breakdown plan before you need it

The best time to think about breakdown finance is while the factory is still humming. A light-touch review now means that when a machine fails, everyone already knows who to call and what rough options are on the table.

For many manufacturers, that looks like a quick review of key plant, existing Plant & Equipment facilities and any idle equity in machinery or vehicles. From there, you can sketch out how much you’d need if your biggest machine stopped tomorrow.

This is also a good time to review your broader funding setup — including general business loans, cashflow tools and specialist manufacturing products — so you’re not relying on one lender or one product for every scenario.

- List the top 3–5 assets that would hurt most if they failed.

- Know roughly how much you’d need to repair vs replace each one.

A Victorian manufacturer reviews their key machines with Switchboard Finance and sets rough limits for “repair”, “hire” and “replace” scenarios. When a conveyor system fails six months later, they already know the likely funding path and only need to confirm final numbers and supplier quotes, not start from scratch.

If you want to keep things simple, you can treat this page as your checklist and bring it to a chat with a broker. Together you can map a light breakdown playbook alongside broader guides like the Business Owners Finance Hub and your existing asset finance strategy.

6. How Switchboard Finance helps manufacturers keep the line moving

Switchboard Finance works with manufacturers who run CNC machines, presses, yellow goods and specialist plant across Victoria and beyond. The focus is simple: fast, clear answers so you know how a breakdown can be funded before you start cancelling jobs.

Depending on your situation, that might mean reviewing existing Equipment Finance, planning a small breakdown facility, or mapping how a future low doc upgrade would sit alongside general business lending and tax planning.

If you already have strong operations and a solid customer base, the next step is usually a short call to map out your breakdown plan and see how it ties in with broader business growth.

- One broker who understands manufacturing, not a call centre script.

- Clear, practical funding options explained in plain English.

You can also read related pieces like Asset Finance for Growing SMEs, Fast-Track Asset Finance for ABN Holders and the manufacturing-focused equipment finance guides to see how breakdown planning fits into your bigger picture.

-

In many cases, yes. A Low Doc Loan can be used to cover urgent repairs or smaller replacement costs if the business is stable, the asset is clearly used for income, and the repayments fit comfortably inside normal trading patterns. A broker can help you match the repair amount to the right style of low doc funding.

-

Timeframes vary by lender and structure, but where the figures stack up and documents are ready, some deals can reach Fast Approval in a matter of hours rather than weeks. The more organised your contracts, quotes and supplier details are, the easier it is to move quickly when a critical machine fails.

-

It depends on the size and timing of the cost. A dedicated facility tied to the asset keeps things clean, while a Working Capital product can help with labour and material spikes that come with rushing jobs after a breakdown. Many manufacturers use a blend of both so they are not leaning on one tool for everything.

-

Most funders will want recent Bank Statements, a clear breakdown quote or replacement invoice, and a simple overview of how important the asset is to your current contracts. From there, your broker can filter policies quickly so you’re only applying where the risk and numbers make sense.

-

Yes. Many manufacturers now treat breakdown planning as part of their wider Asset Refinance and renewal strategy. That might mean lining up pre-approved limits, refreshing older facilities or setting clear rules for when you repair, hire or replace. The aim is to make the next breakdown a manageable event, not a crisis.