The GST Credit Bridge for New Plant (2026)

Buying plant on progress payments can squeeze cash even when you’re “getting GST back.” Here’s how to map BAS timing against milestones — and choose the right facility to bridge the gap.

Case Study (Manufacturing) (2026): One Upgrade, Two Facilities

One upgrade, two facilities: plant finance for the machine, plus a separate cash buffer for install, tooling and supplier timing — and why bundling both would’ve been declined.

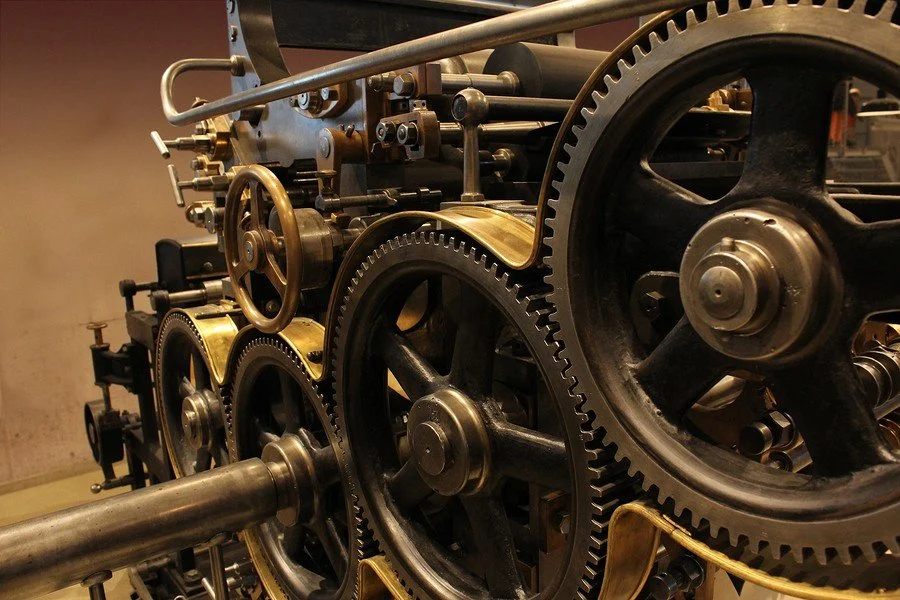

The 10-Minute Inspection That Prevents Valuation Haircuts on Used Factory Machinery

This is the 10-minute “valuation evidence” check that stops used factory machinery valuations getting clipped: serial plate, compliance plate, hours meter, service log, and the exact photos valuers trust.

Factory Plant Finance “Day 0” Submission Bundle (2026)

This is the 10-minute “valuation evidence” check that stops used factory machinery valuations getting clipped: serial plate, compliance plate, hours meter, service log, and the exact photos valuers trust.

Pre-Approval Without Enquiry Damage (2026)

Most “enquiry damage” isn’t bad luck — it’s bad sequencing. This Shadow Underwrite checklist shows how Switchboard screens a deal before any lender touch, so you can confirm fit, spot red flags early, and apply once (cleanly) instead of spraying submissions and hoping.

Can You Transfer a Vehicle or Equipment Loan to Someone Else? (2026)

People constantly ask “can the buyer take over my repayments?” Usually, not directly. This guide breaks down contract substitution vs payout, the PPSR release steps, what triggers declines, and the clean sell sequence that avoids last-minute surprises.

Geelong Seafood & Food Processing Equipment Finance (2026)

Cold-chain approvals fail when the quote is vague and the “real cost” (freight, install, commissioning, stainless drainage, washdown) is hidden. This Geelong checklist shows the docs lenders need — and the valuation/deposit traps that hit specialised processing lines.

Melbourne Childcare Centre Finance Checklist (2026)

Melbourne childcare approvals live or die on proof: lease + permits, enrolment/CCS patterns, staffing ratios, and clean quotes. This checklist is the “proof pack” that keeps fitout + van + equipment funding structured, fast, and low-drama.

The Bridge Stack Rules (2026): How to Sequence Asset Refi + Cashflow Funding

“Just add a working capital facility” is how businesses accidentally create a cross-default mess. This is the clean sequencing rule-set for bridging gaps across industries — with simple do/don’t stages you can follow.

Refi vs Restructure vs Top-Up (2026): The Timing Rules

Most people choose refi vs restructure vs top-up based on “rate” — then get blindsided by discharge timing, valuation gaps, and enquiry stacking. This breaks it down into timing rules and a simple decision path for multi-facility clean-ups.