Excavator Attachments Finance (2025): Buckets, Breakers & Augers Without Draining Cashflow

🦺 Civil & utilities · Attachments · Tradie Hub · 2025

🦺 Civil & utilities · Attachments · Tradie Hub · 2025

Excavator Attachments Finance (2025): Buckets, Breakers & Tiltrotators Without Draining Cashflow

If you’re a tradie contractor doing civil or utility work, attachments are often the fastest way to lift output — but paying cash can wipe your buffer right when your workload ramps up.

The clean approach: finance the attachment like a working asset, keep repayments inside your normal weeks, and save cash for job costs that hit before you get paid.

1) The “attachment ladder”: buy what improves your normal week first

The easiest attachment approvals are the ones with an obvious utilisation story: it gets used on most jobs and removes a real bottleneck (cycle time, rehandling, labour).

Use this ladder to stay approvals-friendly and avoid buying gear that sits idle.

- Step 1: production buckets (GP / trenching / rock) — the “every week” upgrade.

- Step 2: breaker or ripper — when rock or demo is common in your work mix.

- Step 3: tiltrotator — when you’re digging + placing + finishing in one workflow.

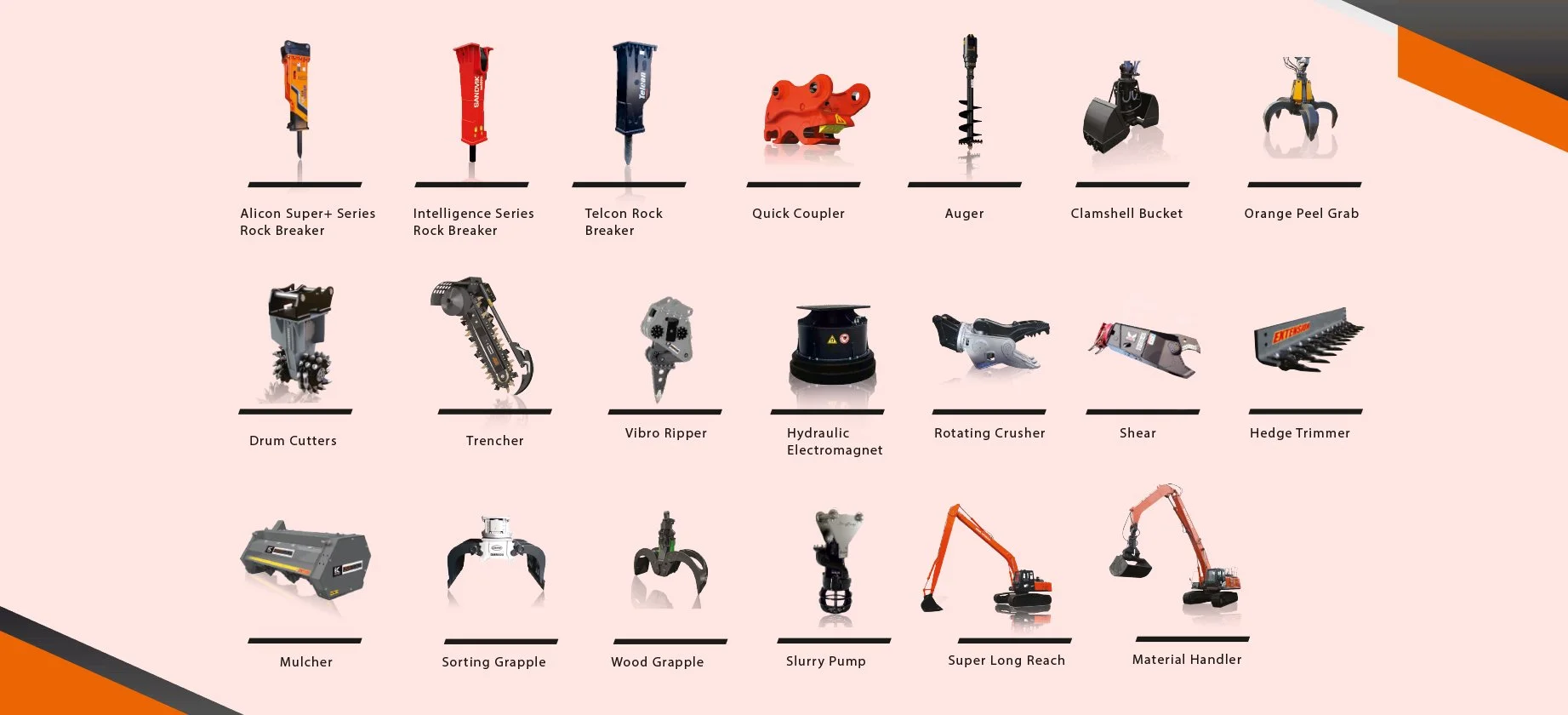

- Step 4: specialist gear (auger / grapple / compaction) — only once the work proves it.

- Paperwork rule: one supplier, clear line items, one repayment story that fits normal weeks.

Real-life example: A drainage contractor funds a trenching bucket + mud bucket first (used every week), then adds a breaker later once rock work becomes consistent — approvals are simpler because the utilisation is obvious.

2) Structure chooser: keep the “asset lane” clean

Attachment finance usually moves fast when it’s a standalone asset request with a clean quote and clear description.

For the category overview, start at Equipment Finance.

If you’re established (often 2+ years trading with stable bank conduct), Low Doc Asset Finance can reduce paperwork friction — but only if repayments still fit your normal weeks.

| Structure | Best when… | What usually matters | Watch-out |

|---|---|---|---|

| Chattel Mortgage | You want ownership upfront | Clear supplier docs + sensible term | Repayments only work in your best month |

| Finance Lease | You want predictable repayments + end options | Attachment description + suitable term | No plan for end-of-term outcome |

| Hire Purchase | You want a simple path to ownership over time | Clean file + stable conduct | Messy spend behaviour around purchase time |

Real-life example: A civil operator speeds up the approval by keeping it “asset-only”: one quote, one supplier, and no unrelated cash requests bundled into the same application.

3) The cashflow rule: separate “asset upgrades” from “buffer funding”

The regret pattern is predictable: you fund the upgrade, then a materials-heavy week lands before the progress claim clears.

That’s not an attachment problem — it’s a buffer problem.

Keep the lanes separate: fund the attachment as an asset deal, and use a dedicated safety net if you have timing gaps.

Start from Business Loans, then choose Business Line of Credit (ongoing swings) or Working Capital Loans (a defined squeeze).

- Quote clarity: line items name the attachment and match the supplier.

- Repayment fit: tested against normal weeks, not peak months.

- Timing: avoid settling right before a materials-heavy fortnight.

- Buffer lane: if you need a safety net, keep it outside the asset request.

Real-life example: A contractor funds a tiltrotator but keeps cash untouched for a concrete pour + subcontractor week. The attachment earns profit; the job stays stress-free.

Summary

Keep excavator attachment finance clean: one supplier, clear paperwork, and repayments that fit your normal weeks.

Treat the attachment as an asset upgrade — and keep buffer funding separate so productivity doesn’t turn into a cash squeeze.

FAQ

Often, yes — attachments can be funded as standalone equipment if the docs are clean and the repayment fits your normal weeks.

This is usually treated under Equipment Finance.

A clear quote plus a clean Tax Invoice with named line items is the biggest speed lever.

One supplier and one story reduces back-and-forth.

GST timing can still pressure cashflow around BAS, even if you finance the asset.

If you’re GST Registered, plan when GST is paid versus when it’s claimed back.

General GST guidance is on ato.gov.au.

Sometimes — but used deals usually hinge on proving clean ownership and reducing title risk.

A PPSR Check is a common part of that risk control before funds are committed.

If lead times are tight or the attachment is expensive, yes — check the numbers first so you’re not stuck mid-job.

A simple Pre-Approval-ready file reduces surprises and delays.