Case Study (Manufacturing) (2026): One Upgrade, Two Facilities

Two-facility plant finance and cash buffer for manufacturing business owners

| Switchboard Finance

🏭 Manufacturing •

case study •

two facilities •

risk logic •

2026 •

Business Owners Finance Hub

🏭 Manufacturing •

case study •

two facilities •

risk logic •

2026 •

Business Owners Finance Hub

This is a structure decision case study — not another “pre-approval plan”. Same upgrade, same borrower, two different ways to fund it: bundled (decline risk) vs split (clean approval path).

If you want the “are we even ready?” baseline first, use: 11 Signs Your Business Is Ready for Asset Finance in 2025. For the main asset lane entry point, start here: Low Doc Asset Finance.

1) The scenario (one upgrade, two needs)

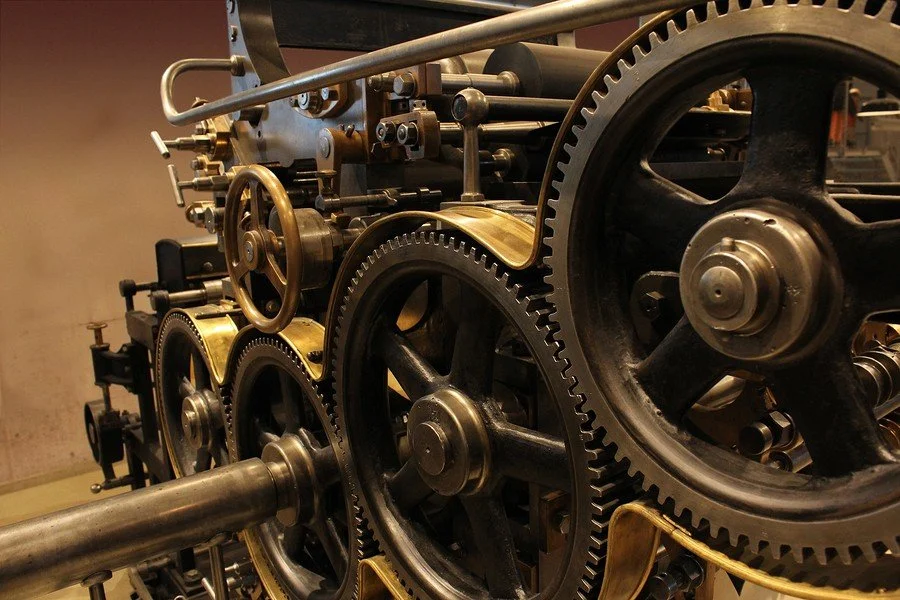

A manufacturing business needed a key machine upgrade to lift throughput. But the “real cost” wasn’t just the machine — it was installation downtime, tooling, training, and supplier timing while production ramped back up.

The owner initially tried to bundle everything into one request: “finance the machine + give me extra cash for the buffer”. That sounds efficient — but it often reads as “asset finance plus cash-out”, which increases credit risk and conditions.

2) Why bundling gets declined (the lender logic)

Plant finance is meant to be secured against the asset. When you bundle a cash buffer into the same facility, the lender can’t cleanly tie the full limit to the machine value — which can trigger a valuation haircut, limit reduction, or a straight decline.

It also blurs repayment logic. A machine produces value over years, but a cash buffer is short-life working money. When those are mixed, the deal looks like “long-term debt funding short-term cash”, which lenders hate.

- Valuation gap: if the asset values at $230k and you asked for $300k, you’ve created an instant shortfall.

- Purpose blur: “equipment finance” becomes “cash-out”, which changes policy lanes.

- Term mismatch: you’re trying to finance short-life cash on a long term length.

3) The split structure (two facilities, one outcome)

We split it into two facilities with two different “stories” — each clean in its own lane. Facility A was pure plant finance secured to the machine value. Facility B was a separate cash buffer with a short, explainable purpose and tighter controls.

You can think of it like two different products doing two different jobs: Asset Finance for the machine, and Working Capital as the buffer. (If you want a simple “equipment product” refresher first, read: Lease vs Buy Equipment.)

| Facility | Purpose | What the lender is comfortable with | Why it’s cleaner |

|---|---|---|---|

| A: Plant facility | Fund the machine purchase | Secured to the asset and its valuation | Limit ties to value; approval criteria stays in the asset lane |

| B: Cash buffer | Install + ramp-up buffer (short life) | Clear use, short window, simple repayment plan | Separates “cash risk” from “asset risk” so policy stays clean |

4) The “proof pack” that made the split work

Two facilities only work if each has a clean evidence trail. The plant side needs clear asset identity + scope. The buffer side needs a clear cashflow rhythm and a simple “what it covers” list.

If you want the fastest submission approach, use the manufacturing “Day 0” pack concept here: Factory Plant Finance “Day 0” Submission Bundle (2026). And if you want to avoid the most common avoidable delays, read: Top 5 Mistakes Business Owners Make When Applying for Equipment Finance.

- Install + commissioning costs (timed to delivery)

- Tooling and initial consumables

- Supplier timing gap during ramp-up

- A defined cap and paydown plan once throughput stabilised

The manufacturing upgrade only worked because we separated “asset risk” from “cash risk”. One plant facility tied to valuation + one separate cash buffer with a short, clear purpose.

If you’re planning a similar upgrade, start with: Low Doc Asset Finance and make the buffer logic clean under Working Capital. If you want the fastest submission workflow, use the manufacturing Day 0 pack: Day 0 Submission Bundle.

FAQ

Because the limit stops matching the asset value and the purpose becomes unclear. It can look like “cash-out” inside an asset facility, which increases risk grade and conditions.

Not always. It depends on structure and security, but conceptually it’s closer to Working Capital than it is to long-term asset funding.

If the machine values lower than expected, you instantly have a shortfall. That can force a lower approved limit, more deposit, or a restructure of the request.

A simple list of what it covers, the time window, and how it gets paid down once throughput stabilises — plus clean Bank Statements to show rhythm.

They keep the evidence pack blended, so both facilities inherit the same confusion. The fix is to separate proof: asset identity for plant; cashflow clarity for the buffer.

Disclaimer: This content is general information only and isn’t financial, legal, or tax advice.