Truck & Farm Transport Facility Ladder 2025: Grow from Fuel Card to LOC, WCL & Invoice Finance

Running grain or livestock trucks on an ABN and feel like your finance is just random cards and overdrafts? This facility ladder shows how to move from basic fuel credit to a structured mix of LOC, Working Capital Loans and Invoice Finance that actually matches your season and cashflow.

Truck & Farm Transport Cashflow Map 2025: Use LOC, WCL & Invoice Finance Around Grain & Livestock Seasons

Run trucks for grain or livestock and feel rich at harvest but tight the rest of the year? This simple 12-month cashflow map shows how LOC, Working Capital Loans and Invoice Finance can follow your seasons instead of fighting them.

Farm Haulage Upgrade Ladder 2025: From Old Farm Truck to Grain & Livestock Rigs on Low Doc Terms

Run your own trucks for grain or livestock? This visual upgrade ladder shows how to go from “old farm truck” to the right mix of rigs, trailers and finance terms without smashing cashflow.

Staggered Fleet Replacement Plan 2025: Spread Truck Loans & Balloons Across a Fleet

A simple, visual truck replacement plan for 3–5 rig fleets so loans, balloons and upgrades don’t all crash into the same year.

Business Finance Safety Net 2025: Set Up LOC, WCL & Invoice Finance Before a Cashflow Crunch

The best time to build a business finance safety net is before cash gets tight. This 2025 guide shows how to set up a low doc-friendly mix of Business Line of Credit, Working Capital Loan and Invoice Finance so you are ready before the crunch hits.

Core Low Doc Cashflow Path: (2025 Roadmap)

You don’t need every product on day one. This 2025 roadmap shows how to start with one low doc facility, then add a Business Line of Credit, Working Capital Loan and Invoice Finance as your trading history, cashflow and confidence grow.

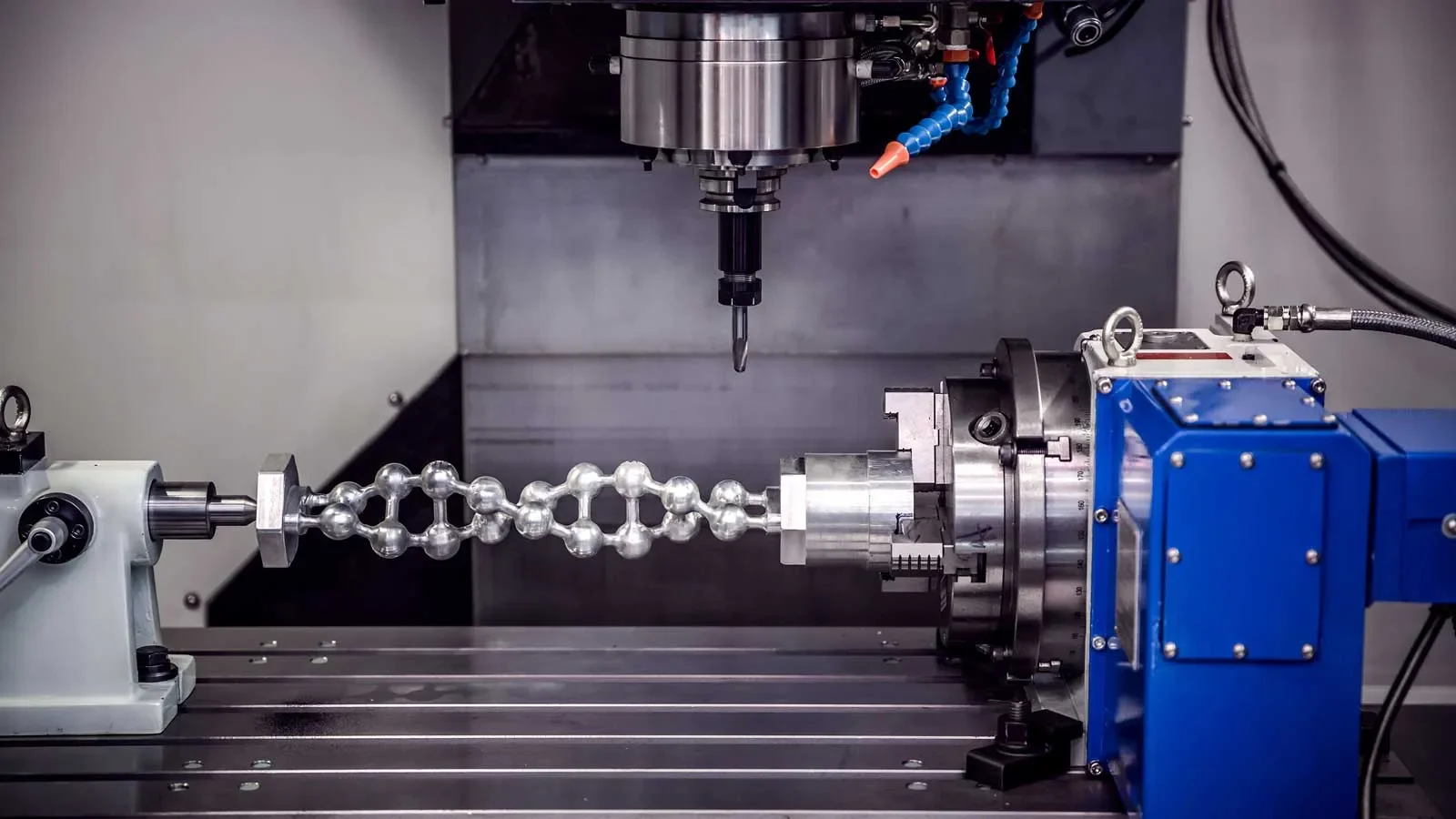

Pre-Approved Manufacturing Upgrades: Line Up Asset Finance (2025 Guide)

Pre-approved upgrade funding is about one thing: knowing you can upgrade plant as soon as a contract lands. This guide keeps it simple for manufacturers — how pre-approved limits work, what to prepare now, and how to use a broker so tenders don’t stall while you scramble for finance.

Manufacturing Breakdown Finance: How to Fund Emergency Repairs (2025 Guide)

When a key machine dies mid-production, you don’t have three weeks to “talk to the bank”. This guide walks manufacturers through simple ways to use asset finance and short-term business funding to cover emergency repairs, hire replacement gear or swap in a new unit — without freezing production or smashing cashflow.

What Is Residual Value in Asset Finance?

Residual value is the part of an asset finance deal everyone skips over – but it quietly controls your repayments, balloon strategy and end-of-term risk. This simple 2025 guide shows you how residuals work, how they shape cash flow, and how to avoid a nasty surprise at the end of the term.

Finance Lease vs Operating Lease

Most owners just get told “it’s a lease” and sign. This simple 2025 guide breaks down the real difference between a finance lease and an operating lease, so you can match the right structure to your equipment, tax position and upgrade plans.