BAS + Fuel + Repairs Buffer (2025): Facility Usage Rules for Transport Operators

Transport cashflow breaks when BAS, fuel and repairs hit at the same time. This guide shows a simple “3-bucket buffer” and facility usage rules (LOC, working capital, invoice finance) to keep weekly runs stable — without accidentally funding CAPEX with short-term money.

Docket-to-Pay Cycle + Invoice Finance (Transport-Specific) (2025)

In transport, cashflow breaks when dockets don’t become clean invoices fast. Here’s how to tighten your docket-to-pay cycle (POD → billing → payment), and where invoice finance fits when your customers pay on 30–60 day terms.

Mixed Income (Farm + Cartage) and Low Doc Assessment (2025)

If your income is split between farming and cartage, low doc approvals can still be clean — but only if you separate the streams, explain seasonality, and package the documents the way assessors read them.

Backhauls & Empty KM for Truckies/Truckers (2025): A Dispatch Checklist That Lifts Weekly Margin

Empty kilometres are quiet profit killers. This guide shows a simple dispatch scorecard + backhaul rules that reduce dead runs, protect your week, and help your fleet’s numbers look cleaner when you’re ready to upgrade.

ABN Age & Approval Limits (2025): How Lenders Size LOC, Working Capital & Invoice Finance

Two businesses can have the same revenue and get wildly different outcomes—purely because of ABN age and how stable the cashflow looks on statements. This guide breaks down how lenders commonly size limits across LOC, working capital and invoice finance, so you pick the product that matches where your business is right now (and still scales later).

Low Doc Cashflow Facility Documents Checklist (2025): LOC, Working Capital & Invoice Finance

Most “fast approvals” aren’t about luck—they’re about sending the right evidence in the right order. This checklist shows exactly what to prepare for a low doc LOC, working capital loan, or invoice finance facility so you don’t get stuck in a back-and-forth that burns weeks.

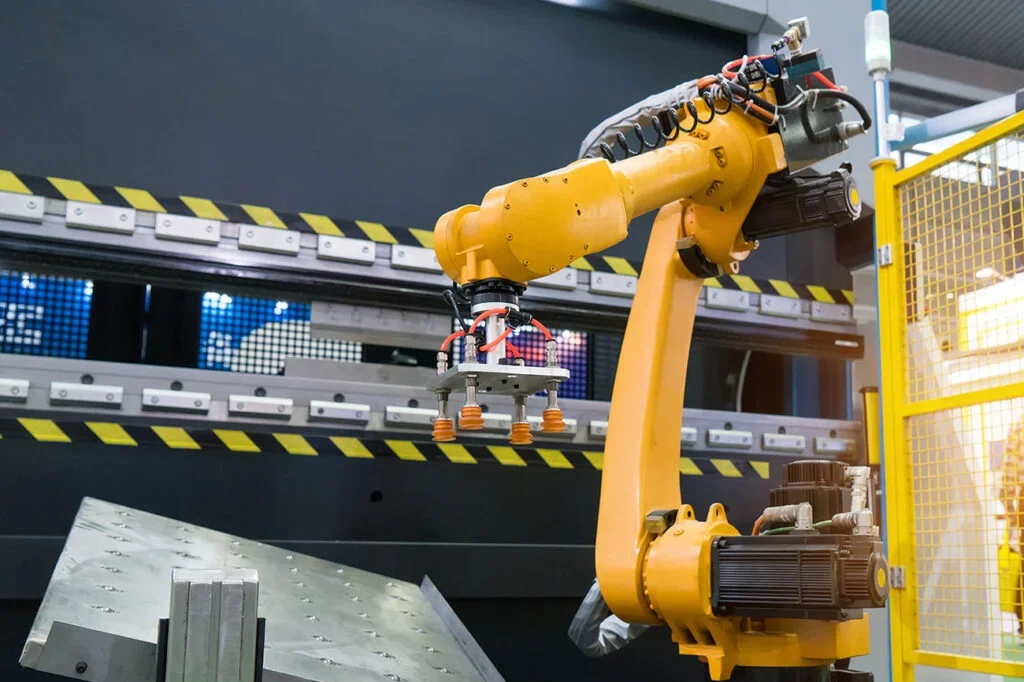

Used Machinery Finance for Manufacturing (2025): Auctions, Imports, Deposits & Risk Checks

Used machinery can unlock manufacturing capacity fast — but only if the deal is finance-ready. This guide breaks down how lenders assess auctions, imports, deposits, and risk checks in 2025, so you can secure funding without settlement delays or cashflow blowouts.

Tooling & Dies Finance for Manufacturers (2025): Moulds, Jigs, Fixtures & Tooling Packages

Tooling is the upgrade that actually increases output—but it’s also the spend that quietly nukes cash reserves. This guide breaks down how manufacturers finance moulds, dies, jigs and fixtures (including “tooling package” quotes), what lenders want to see, and how to structure the deal so the repayments match your production cycle.

Loan Covenant Explained (2025)

A loan covenant isn’t “bad” — it’s a rulebook. Here’s how covenants work, what usually triggers them, and how to avoid accidental breaches that can mess with renewals or refinancing.

Sydney Skip Bin Finance (2025): Low Doc Options for Builders, Demo & Landscaping

If you’re turning down jobs because you don’t have enough skip bins, this guide shows how Sydney operators commonly fund extra bins on low doc terms — without blowing up cash flow.