Automation Finance 101 (2025): Cobots, Conveyors & Packaging Lines

🏭 Automation · Asset Finance · Business Owners Finance Hub · 2025

🏭 Automation · Asset Finance · Business Owners Finance Hub · 2025

For manufacturers and SMEs investing in factory automation, the approval outcome is rarely about “cool tech”. It’s about whether the upgrade is clean Plant & Equipment (financeable) or a mixed bundle of CAPEX + OPEX (harder to fund under one simple structure). Your ABN, Trading History, and real Cashflow still do the heavy lifting.

This 101 shows what typically qualifies for Equipment Finance, how lenders assess automation risk, and the clean structures businesses use to protect repayments. If you’re deciding “own vs rent” first, start with Lease vs Buy Equipment and for lease structures see Finance Lease vs Operating Lease.

- If the quote is mostly physical equipment with a clear Asset Type, asset finance is usually the cleanest path.

- If the quote is “software + integration + training” heavy, you may need a split plan (asset finance + a Business Loan facility).

- For low-doc simplicity on gear upgrades, start at Low Doc Asset Finance or Equipment Finance.

1) What counts as “financeable automation” (and what doesn’t)

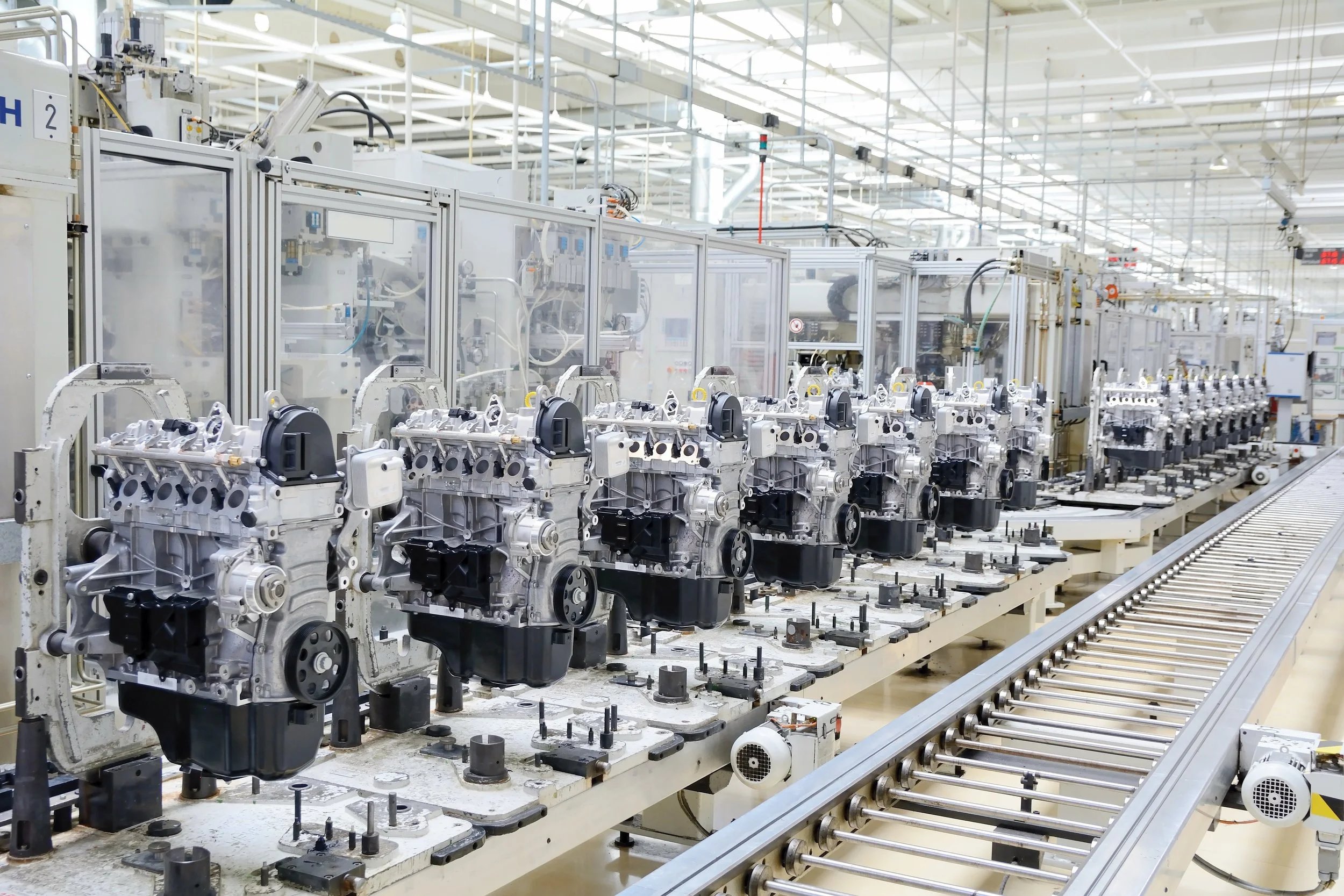

In asset finance, automation is easiest when it looks like a standard Machinery Finance file: a physical asset, a clear supplier Tax Invoice, and a usable life that matches the Useful Life of the equipment. Think cobots, conveyors, packaging lines, pallet wrappers, labelers and QC stations.

Where approvals get messy is the “bundled quote”: hardware + software licences + commissioning + plant rewire + training. Some of that is still CAPEX, but it’s not always a clean security-backed asset. If the quote is mixed, a common approach is to fund the hard equipment via Asset Finance and cover implementation/working costs via a cashflow facility (see the trio inside Business Loans).

If you’re buying second-hand automation or importing machinery, the risk checks matter more. Start with Used Machinery Finance for Manufacturing and if you’re unsure whether to patch or replace a line, see Repair or Replace a Production Machine.

- Separate line items for equipment vs install vs software (helps Approval Criteria).

- Model/specs + serial/VIN equivalents where available (speeds Settlement).

- Clear GST status (e.g., GST Registered supplier) and totals.

- Cobots/robot arms, conveyors, case packers, pallet wrappers, labeling systems.

- Safety scanning/light curtains that are part of the machine package.

- Ancillary hardware that ships with the line (guards, frames, standard controls).

2) How lenders assess automation risk (so you don’t get stuck mid-approval)

Automation approvals are still basic underwriting: can you service it, and can the lender rely on the asset as security? That means clean Bank Statements (or Bank Feeds), plus trading consistency that supports Borrowing Capacity. Lenders also watch concentration risk (one big customer) and timing risk (payroll and supplier timing).

The second risk test is “term fit”: automation shouldn’t be financed longer than the real life of the equipment. That’s where Term Length and the asset’s Useful Life matter. If your repayments look tight in slower months, you’ll often get a cleaner outcome by pairing the asset loan with a buffer facility (see Working Capital Loans or a Business Line of Credit).

If the automation is part of a bigger “upgrade cycle” (machine + tooling + extra shifts), lenders like seeing a clear plan. Manufacturing-specific reads that help frame this: Pre-Approved Manufacturing Upgrades, Tooling & Dies Finance for Manufacturers, and if you need a repair fallback plan, Manufacturing Breakdown Finance.

| What underwriting looks at | What “good” looks like | What slows approvals | Best internal next link |

|---|---|---|---|

| Cashflow + servicing | Stable trading + clear buffers | Big swings without explanation | Cash Flow Warning Signs |

| Asset clarity | Clear specs + invoice + installation scope | One “lump sum” quote with mixed scope | Equipment Finance Application Mistakes |

| Structure fit | Term matches Useful Life | Repayments sized for “best month” only | Are Low Doc Equipment Loans Worth It? |

- Get your supplier to break out the quote into equipment vs install vs software (cleaner Secured Loan logic).

- Choose a Term Length that survives slower months (helps Affordability).

3) Structuring options: finance lease, operating lease, chattel mortgage (and when each wins)

Automation isn’t one product — it’s a set of structures. The “right” one depends on whether you want ownership, the balance-sheet treatment, and how you want repayments to behave over time. The three common structures you’ll see in automation deals are Finance Lease, Operating Lease, and Chattel Mortgage.

If you’re comparing leases, start with Finance Lease vs Operating Lease. If you’re trying to reduce monthly pressure, the lever is usually a Balloon Payment (also called Residual Value or Residual Balloon), but you must plan the exit (payout, refinance, or replace).

For businesses already carrying machinery facilities, automation often becomes a “refinance + upgrade” conversation. If you need to reset repayments or tidy an old deal, learn the terminology at What Is a Payout Figure? and if you’re choosing whether to keep one big facility or split across assets, the structure logic is similar to One Facility vs Split Facilities.

| Structure | Best for | Watch-outs | Glossary anchor |

|---|---|---|---|

| Chattel Mortgage | Ownership-focused upgrades on core machines | Plan for end-of-term exit and any Exit Fees | Chattel Mortgage |

| Finance Lease | Flexible ownership pathway (business use) | Know what happens at end-of-term (Early Termination risk) | Finance Lease |

| Operating Lease | Shorter upgrade cycles / tech refresh | Check replacement and return conditions | Operating Lease |

- Match term to reality: choose a Term Length aligned with the machine’s Useful Life.

- Split “asset vs buffer”: fund equipment via Low Doc asset finance and keep a safety net via Working Capital or Line of Credit.

4) The common mistakes that quietly kill automation approvals

Most automation “declines” aren’t a hard no — they’re an unclear story. If the lender can’t separate the asset from the services, the file stops looking like Asset Finance and starts looking like an unsecured spend request (which changes rates, limits, and conditions).

The second killer is a structure mismatch: long terms on short-life tech, or a big Balloon Payment without an exit plan. If you’re unsure how balloon / residual strategy impacts approvals, read Residual Value in Asset Finance. And if you want to see the “what not to do” patterns, start with Top 5 Equipment Finance Application Mistakes.

The third killer is ignoring covenant-style expectations (especially for larger facilities): lenders want to know what happens if a customer slows down, a commissioning delay hits, or you need to swap suppliers. If you’re reviewing facility obligations, see Loan Covenant Explained, and for personal exposure, Director’s Guarantees Explained.

- Lump-sum quote: no breakdown of equipment vs install/software (fails clean Approval Criteria).

- Missing evidence: weak Bank Statements or unclear Trading History.

- Term mismatch: unrealistic Term Length vs Useful Life.

- No exit plan: a big Balloon Payment with no refinance/replace plan.

- Clarify the asset: specs + invoice + supplier details (speeds Settlement).

- Clarify the cashflow: show the repayment plan survives slow months (supports Cash Flow Assessment).

- Clarify the structure: pick the right facility type and term (see Lease vs Buy).

Factory automation approvals are easiest when the upgrade reads as clean Plant & Equipment with a clear invoice. When quotes bundle software, install and training, the fastest path is often “asset + buffer” (equipment finance + a cashflow facility).

If you want the most direct path to revenue pages: Low Doc Asset Finance (automation/equipment), Business Loans (cashflow facilities), and the trio pages: Business Line of Credit, Working Capital Loans, Invoice Finance.

FAQ

Often, yes — but it’s cleanest when the quote separates the physical equipment from services. The equipment portion usually fits Asset Finance, while the “people/time” portion can suit a Business Loan facility, depending on Approval Criteria.

It depends on whether you want ownership and how often you expect to refresh the tech. A Finance Lease can suit longer-life equipment, while an Operating Lease can suit shorter upgrade cycles — but always match Term Length to real life.

Sometimes. A Balloon Payment (or Residual Value) can reduce monthly pressure, but you need a clear end plan (payout, refinance, or replace). If you don’t plan the exit, you risk higher Payout Figure stress later.

Usually: clean Bank Statements, stable Trading History, and a repayment plan that works under a conservative Cash Flow Assessment. If the quote is mixed scope, split it — it helps underwriting move faster.

Sometimes, yes — especially where the lender wants stronger comfort around repayment risk. A Director’s Guarantee is more common when the facility is more “cashflow-like” than asset-secured, or when the deal is larger relative to demonstrated Borrowing Capacity.

For general tax guidance starting point, see ato.gov.au.

Disclaimer: This content is general information only and isn’t financial, legal, or tax advice.